Gold prices were little changed on Friday, but the metal was headed for a second straight weekly drop as a stronger dollar and U.S. Federal Reserve’s hawkish policy stance clouded outlook for the non-yielding bullion.

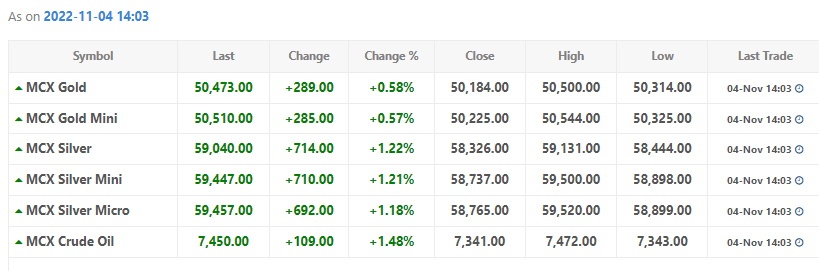

Spot gold rose 0.1% at $1,631.33 per ounce, as of 0043 GMT, but it was down 0.6% for the week so far.

U.S. gold futures rose 0.2% to $1,633.70.

The dollar index was set for its biggest weekly gain since Sept. 23.

On Wednesday, the Fed raised interest rates by 75 basis points and Chair Jerome Powell vowed to “keep at” their battle to beat down inflation.

Gold is considered an inflation hedge, but rising interest rates dent the non-yielding asset’s appeal.

Investors’ focus now shifts to the U.S. nonfarm payrolls data for October due at 1230 GMT, which could offer further cues on the Fed’s rate-hike plan.

SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, said its holdings fell 0.82 percent to 911.59 tons on Thursday from 919.12 tons on Wednesday.

Meanwhile, the Bank of England raised interest rates by the most since 1989 on Thursday but warned investors that the risk of Britain’s longest recession in at least a century means borrowing costs are likely to rise less than they expect.

Spot silver was flat at $19.46, platinum fell 0.1% to $917.84 and palladium was steady at $1,800.81.