Gold prices on Thursday steadied near a two-month high hit in the previous session, with higher U.S. Treasury yields preventing any gains amid caution building around developments at the U.S. Federal Reserve’s meeting due next week.

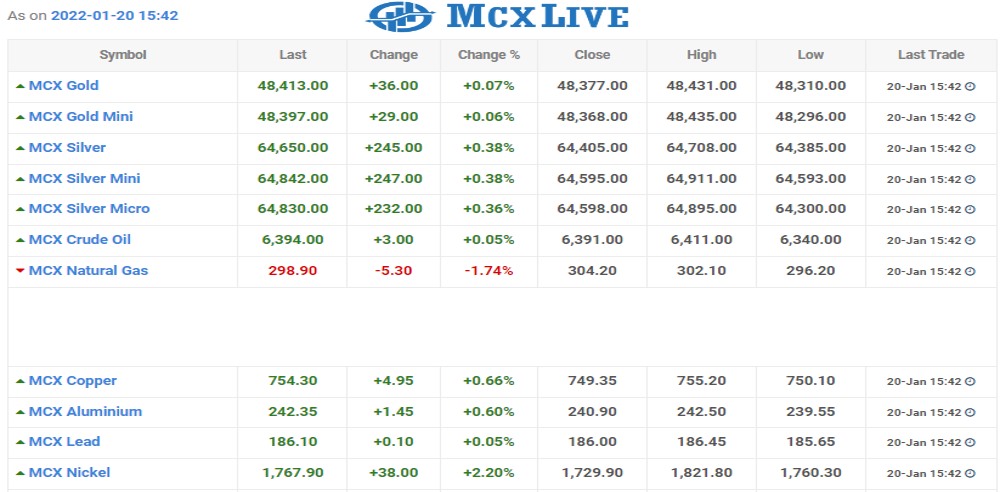

Spot gold was flat at $1,839.36 per ounce as of 0031 GMT, steadying near its highest since Nov. 22. U.S. gold futures were down 0.1% at $1,840.60.

Gold saw its best session in three months on Wednesday as a retreat in the dollar and geopolitical tensions surrounding Ukraine lifted safe-haven appeal, sparking a rally in precious metals.

Benchmark U.S. 10-year Treasury yields were higher on Thursday, lightly pressuring gold.

The U.S. Federal Reserve will tighten monetary policy at a much faster pace than thought a month ago to tame persistently high inflation, now viewed by economists polled by Reuters as the biggest threat to the U.S. economy over the coming year.

The U.S. central bank’s Federal Open Market Committee is scheduled to meet on Jan. 25-26.

Although gold is considered an inflationary hedge, the metal is highly sensitive to rising U.S. interest rates, which increase the opportunity cost of holding non-interest bearing bullion.

Strong U.S. and European corporate results could not stop a slide on Wall Street, as rising crude prices kept inflation concerns alive.

Inflation in Britain rose faster than expected to its highest in nearly 30 years in December, intensifying a squeeze on living standards and putting pressure on the Bank of England to raise interest rates again.

Spot silver was down 0.1% at $24.09 an ounce, platinum edged 0.1% higher to $1,022.60, and palladium fell 0.4% to $1,992.71.