Gold prices inched lower on Wednesday as traders looked forward to U.S. Federal Reserve minutes and key inflation data for clues on the pace of future interest rate hikes.

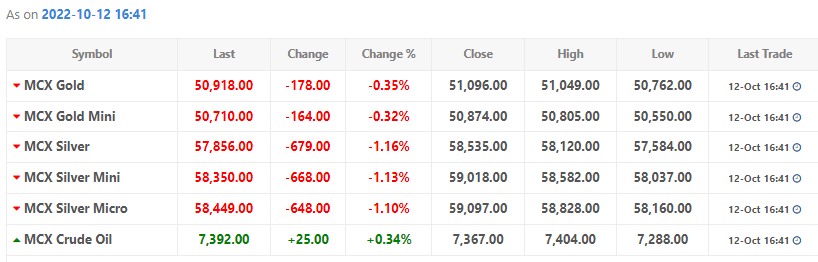

Spot gold fell 0.1% to $1,663.60 per ounce, as of 0055 GMT, hovering close to a one-week low touched on Tuesday.

U.S. gold futures were down 0.8% at $1,673.30.

The dollar index and benchmark U.S. 10-year Treasury yields were steady in early Asian hours.

The Federal Open Market Committee will issue minutes of its Sept. 20-21 meeting at 1800 GMT later in the day. The U.S. inflation reading will be released on Thursday and could cement expectations of another big rate hike at the November meeting.

Federal Reserve Bank of Cleveland President Loretta Mester said on Tuesday that even with a large amount of rate rises this year, the central bank has yet to get surging inflation under control and will need to press forward with tightening monetary policy.

While gold is considered as a hedge against inflation and economic uncertainties, rising interest rates reduce the appeal of the asset, which pays no interest.

The International Monetary Fund warned on Tuesday that colliding pressures from inflation, war-driven energy and food crises and sharply higher interest rates were pushing the world to the brink of recession.

Peru plans to formalize small-scale gold miners, mining minister Alessandra Herrera said on Tuesday, amid growing international pressure to shed light on the supply chain of the precious metal in South America’s top producer.

Spot silver fell 0.6% to $19.08 per ounce, platinum rose 0.3% to $888.37 and palladium dipped 0.5% to $2,129.99.