Gold steadied on Friday with gains capped by a stronger dollar, but the metal was still set for a sixth straight weekly rise ahead of the U.S. Federal Reserve’s rate decision next week.

Spot gold edged up 0.1% to $1,931.61 per ounce, yet gave up gains earlier in the session after data showed U.S. consumer spending fell in December, even as the core personal consumer expenditure index gained 0.3% month-on-month.

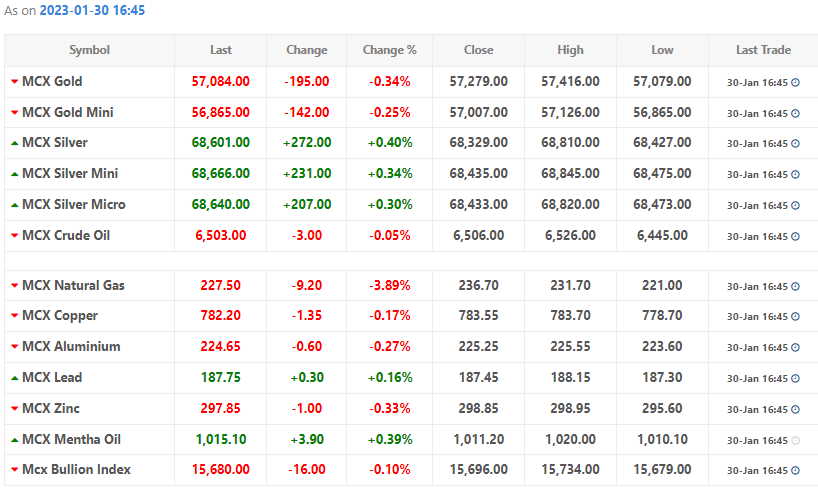

U.S. gold futures remained unchanged at $1,930.20, with gold looking to rise 0.2% for the week.

?[The Fed] needs to be convinced and their favorite indicators are showing inflation is cooling, but I think there still needs to be a bit more work done,” said Edward Moya, senior market analyst at OANDA.

The market was still good for gold as a recession would be bullish, and bullion could still thrive in a smaller-rate-hike environment, Moya added.

Data on Thursday showed the U.S. economy grew faster than expected, causing gold to retreat more than 1%.

The weak handover to 2023 raises the risks of a recession by the second half of the year, but also reduces the need for the Fed to maintain its overly aggressive monetary policy.

The dollar index was 0.1% higher, making greenback-priced gold less attractive to holders of other currencies.

Fed policymakers have signaled they expect rates ultimately to go a bit higher – to just over 5% – while traders are looking out for a terminal rate of 4.9% in June. A quarter-basis-point rate hike has been priced in by most.

Gold, which pays no interest, tends to benefit when interest rates are low as it reduces the opportunity cost of holding bullion.

Spot silver dropped 1.4% to $23.5675 per ounce, platinum was down 0.6% to $1,012.25, while palladium dipped 3.3% to $1,622.14.