Gold prices slid 1% on Monday as the dollar strengthened and as investors turned cautious in the run-up to minutes of the previous U.S. Federal Reserve policy meeting amid hawkish comments from the central bank officials.

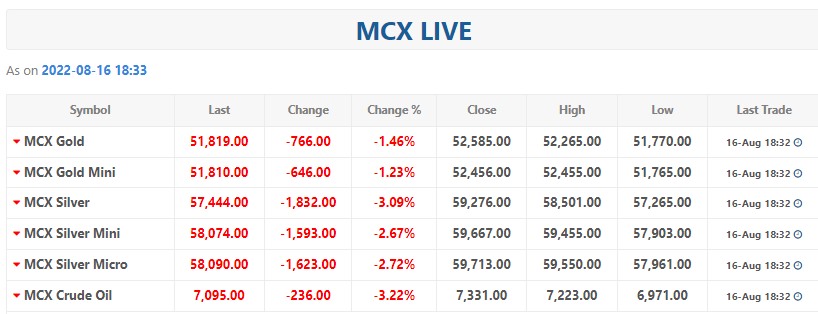

Spot gold was down 1.28% at $1,778.74 per ounce, after rising about 1.6% last week. U.S. gold futures dropped 1.14% to $1,794.8.

“Gold is struggling to shine this morning amid a stabilizing dollar and concerns over China’s physical demand for the precious metal in the face of slowing economic growth,” said Lukman Otunuga, senior market analyst at FXTM.

The Federal Open Market Committee (FOMC) minutes will be closely scrutinized by investors, and “given how gold remains sensitive and quite reactive to anything relating to interest rates and inflation, the precious metal could turn volatile,” Otunuga added.

The FOMC minutes of the July 26-27 meeting will be released on Aug. 17.

Richmond Fed Bank President Thomas Barkin said on Friday he wanted to raise interest rates further to bring inflation under control. Rising U.S. interest rates dim non-yielding bullion’s appeal. The dollar index strengthened 0.5% making gold more expensive for buyers holding other currencies.

Meanwhile, China’s economy unexpectedly slowed in July, with factory and retail activity squeezed by Beijing’s zero-COVID policy and a property crisis. The country is the world’s biggest gold consumer. UK inflation numbers for July, due later this week, are also on investors’ radar.

However, Rupert Rowling, a market analyst at Kinesis Money said that what happens in the U.S. is by far the biggest driver for gold, and “the actions of the Federal Reserve far outweigh the Bank of England when it comes to the impact on gold prices.”