Gold eased from an earlier near three-week high on Monday as investors prepared for Congressional testimony from Federal Reserve Chair Jerome Powell this week and monthly U.S. jobs data, both of which could influence interest rate policy.

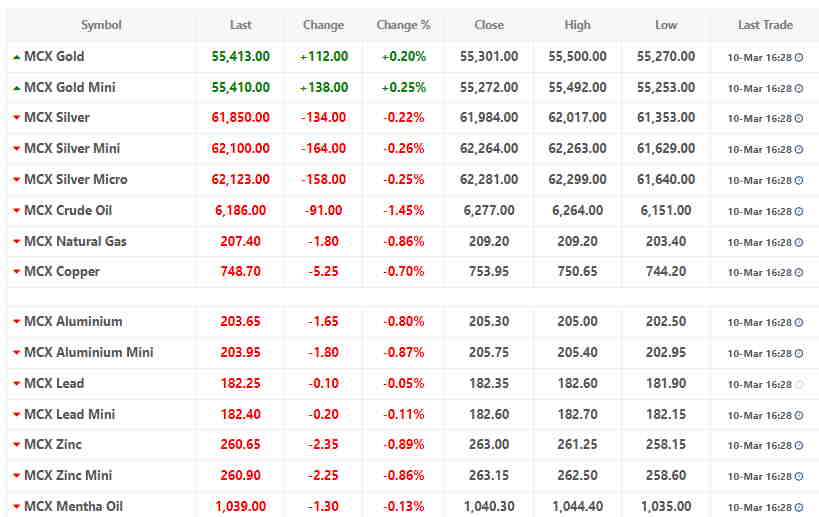

Spot gold was down 0.5% at $1,846.54 per ounce by 2:56 p.m. ET, after hitting its highest since Feb. 15 at $1,858.19. U.S. gold futures settled unchanged at $1,854.60.

Powell’s testimony to Congress is set for Tuesday and Wednesday, followed by the February U.S. jobs report due on Friday.

Jim Wyckoff, senior analyst at Kitco Metals, said there was some trepidation ahead of those two data points which will likely set the near-term tone for gold prices, adding that there could be more volatility after the jobs report.

“The marketplace is expecting a stronger jobs reading which would mean the Fed’s interest rates are going to stay higher for longer,” he said. “That could throw a monkey wrench into this recent rally that we’ve seen in gold.”

Prices are up over 2% since dropping to their lowest since late December last week. Rising rates tend to decrease the appetite for zero-yield bullion.

San Francisco Fed President Mary Daly said on Saturday that if data continued to come in hotter than expected, interest rates would need to go higher and stay there longer.

“Currently, gold is in a wait-and-see mode,” said UBS analyst Giovanni Staunovo. “There’s unlikely to be a change of script from Powell, reiterating the need for further rate hikes to bring inflation under control.”

The dollar index dipped 0.3%, making the greenback-priced bullion less expensive for overseas buyers and limiting losses on the day. [USD/]

Spot silver fell 1.1% to $21.01 per ounce. Platinum slipped 0.2% to $975.14 and palladium dropped 1% to $1,438.56.