Gold prices inched higher on Thursday as investors weighed the chances of the U.S. Federal Reserve slowing its pace of interest rate hikes, while a firmer dollar capped bullion’s gains.

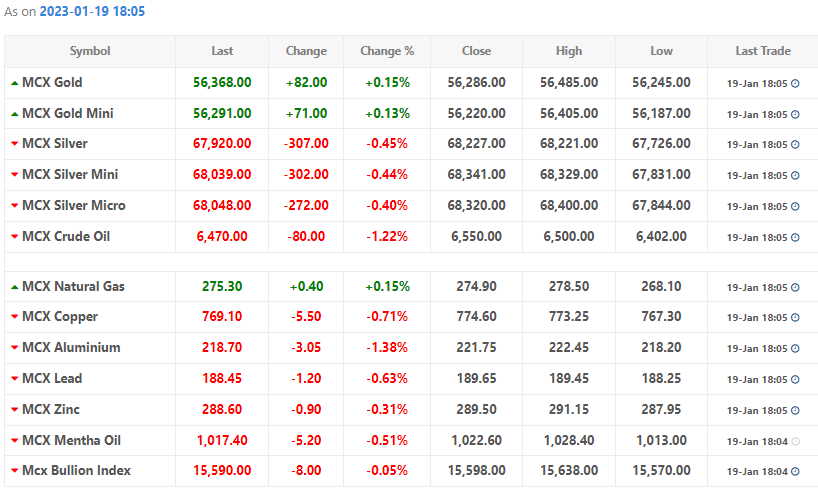

Spot gold was up 0.1% at $1,906.01 per ounce, as of 0252 GMT. U.S. gold futures fell 0.1% to $1,906.00.

Few Fed officials signalled on Wednesday that they would push on with more interest rate hikes, while Philadelphia Fed President Patrick Harker and Dallas Fed President Lorie Logan said they supported a slower pace of tightening.

Traders are mostly pricing in a 25-basis point rate hike at the Fed’s Jan. 31-Feb. 1 meeting. Last year, the U.S. central bank slowed its pace of hikes to 50 bps in December after four straight 75-bp increases.

Markets still see a 25-bp hike in February and rate cuts from September, and gold is enjoying the perceived less hawkish Fed, said Matt Simpson, a senior market analyst at City Index.

Lower interest rates tend to boost bullion’s appeal as they decrease the opportunity cost of holding the non-yielding asset.

Limiting gold’s gains, the dollar index climbed 0.1%. A stronger dollar makes greenback-priced bullion more expensive for overseas buyers.

“If gold can hold above $1,895, then prices will hold within the $1,900–$1,920 range, whereas a break below $1,895 signals a retracement against its bullish trend, ahead of a break above $1,930,” Simpson said.

Data on Wednesday showed U.S. producer prices fell more than expected in December, offering more evidence that inflation was receding, while retail sales fell by the most in a year, putting consumer spending and the overall economy on a weaker growth path heading into 2023.

The weekly U.S. jobless claim data due at 1330 GMT is on investors’ radar.

Spot silver lost 0.2% to $23.38 per ounce, platinum was flat at $1,038.38, and palladium fell 0.1% to $1,716.13.