Gold prices regained some ground on Thursday as the U.S. dollar pulled back, although prospects of more interest rate hikes by the Federal Reserve kept investors on edge.

Spot gold was up 0.3% at $1,840.94 per ounce, as of 0333 GMT, after hitting its lowest level since early January on Wednesday. U.S. gold futures

rose 0.3% to $1,850.20.

Higher interest rates discourage investment in non-yielding gold, although it is considered a hedge against soaring prices.

“Though the recent positive U.S. economic releases and a firm U.S. dollar continue to put pressure on the safe-haven status of gold, there are chances of a mild technical bounce-back as prices dipped to multi-week lows,” said Hareesh V, head of commodity research at Geojit Financial Services.

Data on Wednesday showed U.S. retail sales rebounded in January after two straight monthly declines, pointing to the economy’s continued resilience despite higher borrowing costs.

The strong retail sales numbers, along with Tuesday’s data showing stubbornly high U.S. inflation for last month, have reinforced concerns that the Fed would keep interest rates higher for longer.

The data releases may give the Fed confidence to hike rates further, putting pressure on bullion in the short term, Geojit’s Hareesh said.

Several Fed policymakers this week have signaled that more hikes were needed to bring inflation down to the central bank’s 2% target.

Money markets are expecting the Fed’s target rate to peak above 5.2% in July, from a current range of 4.50% to 4.75%.

The dollar index was down 0.3% after hitting a near six-week peak on Wednesday, making greenback-priced gold less expensive for overseas buyers. Benchmark 10-year Treasury yields hit their highest since Jan. 3.

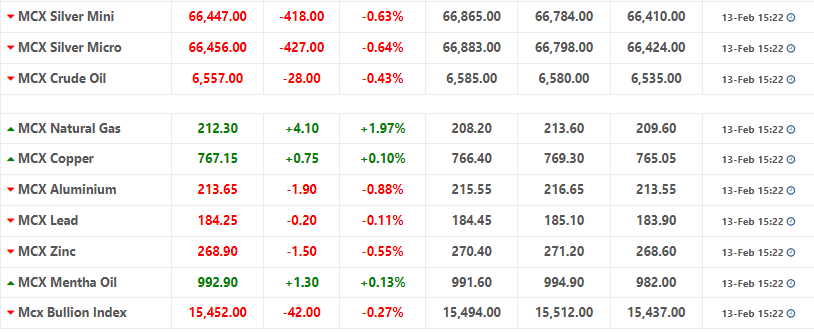

Spot silver rose 0.7% to $21.77 per ounce, platinum was 0.6% higher at $920.16 and palladium gained 1% to $1,479.16.