Gold dipped on Monday, extending its steep sell-off from the previous session, as U.S. bond yields and the dollar strengthened.

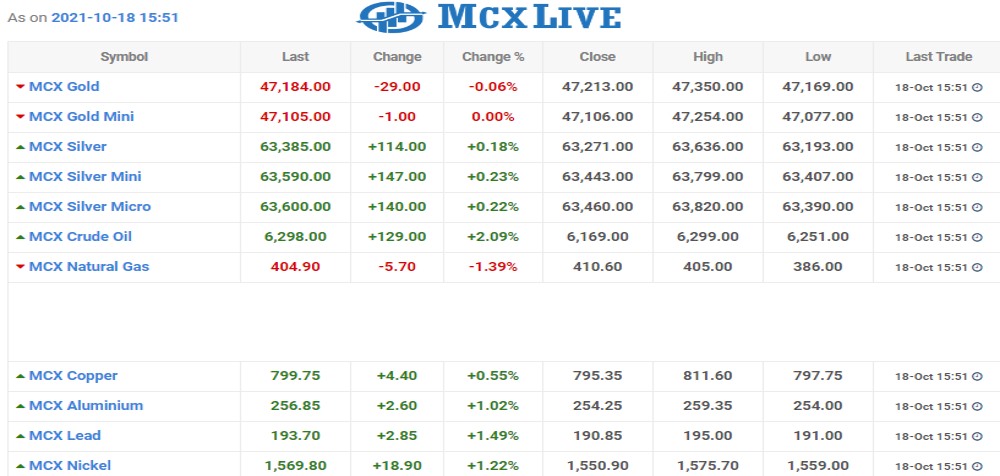

Spot gold fell 0.2% to $1,764.22 per ounce by 0701 GMT, after Friday’s 1.6% slide. U.S. gold futures declined 0.2% to $1,764.70.

Denting gold’s appeal by raising the non-yielding asset’s opportunity cost, benchmark U.S. 10-year Treasury yields moved up and were close to last week’s multi-month highs.

Treasury yields rose sharply on Friday after an unexpected rise in September’s U.S. retail sales brought forward expectations for an interest rate hike by the Federal Reserve.

“Price pressures around the world only heighten the conditions for central banks to tighten their monetary policies – that’s not good for gold and it should trend lower over time,” said Kyle Rodda, an analyst at IG markets.

The dollar also strengthened, making gold more expensive for buyers in other currencies.

Investors also took stock of data showing China’s economy grew slower than expected in the third quarter with power outages and supply bottlenecks hurting factories.

“The concern is that these supply bottlenecks are bad for growth and also put upward pressure on inflation, but markets are signaling that central banks will prioritize inflation risks and tighten policy even if that leads to slightly weaker growth,” Rodda said.

Gold is often considered an inflation hedge, though reduced stimulus and interest rate hikes push government bond yields up, raising the opportunity cost of holding non-yielding bullion.

“The lack of staying power from gold longs suggests that it will struggle to maintain any upward momentum, even if gold reaches $1,800,” said Jeffrey Halley, senior market analyst for Asia-Pacific at OANDA.

Halley also noted that it could take economic growth falling into negative territory to spark renewed safe-haven interest in gold.

Spot silver fell 0.1% to $23.26 per ounce, while platinum eased 0.7% to $1,047.58 and palladium dropped 0.2% to $2,068.36.