Gold prices edged lower on Monday on a firmer dollar as investors squared positions before U.S. inflation data that could influence the Federal Reserve’s rate-hike roadmap.

Spot gold was down 0.2% at $1,861.95 per ounce, as of 0302 GMT. U.S. gold futures eased 0.1% to $1,872.20.

Bullion is often seen as an inflation hedge, but the opportunity cost of holding it is higher when interest rates are raised to combat inflation.

“A firmer U.S. dollar and higher Treasury yields continue to put gold prices under pressure as expectations of a prolonged disinflation story are being challenged,” said Yeap Jun Rong, a market analyst at IG.

The dollar index edged up 0.1%. A stronger greenback makes dollar-priced bullion a less attractive bet for overseas buyers. Benchmark 10-year note yields hovered near their highest level since Jan. 6.

Philadelphia Federal Reserve President Patrick Harker said on Friday that he sees the Fed’s policy rate going up to somewhere above 5% and holding there for a while, and flagged the prospect of rate cuts in 2024. Market participants now expect the Fed’s target rate to peak at 5.188% in July.

“A cautious tone for gold prices could continue to linger in the lead-up to the U.S. CPI data, as any upside risks to inflation being presented could push back against recent dovish expectations and lead markets to revisit the possibility of higher-for-longer rates,” Yeap said.

Data on Tuesday is likely to show the U.S. monthly consumer prices climbing 0.4% month-on-month in January, according to a Reuters survey of economists.

The Labor Department’s annual revisions of CPI data on Friday showed the consumer price index edged up 0.1% in December rather than dipping 0.1% as reported last month.

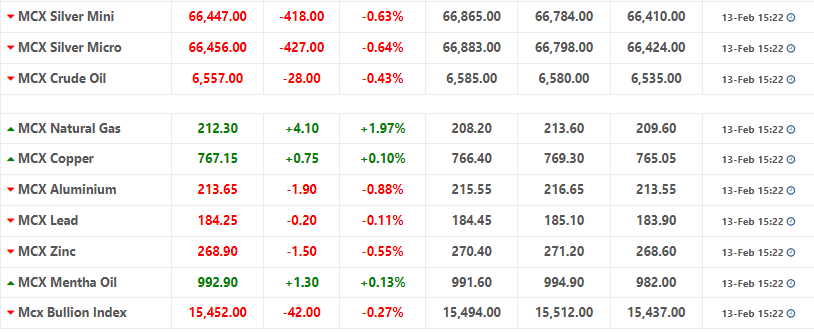

Spot silver fell 0.5% to $21.89 per ounce, platinum lost 0.4% to $941.06, while palladium rose 0.7% to $1,552.80.