Silver prices climbed higher on July 29, tracking strength in the gold, industrial metals and feeble dollar. The precious metal had soared 0.92 percent yesterday on the COMEX.

The white metal traded in the green after a gap-up start in the afternoon session, tracking a bullish global trend.

The semi-precious metal has been trading higher than 5 and 200 days’ moving averages but lower than the 20, 50, and 100 days’ moving averages on the daily chart. The momentum indicator Relative Strength Index (RSI) is at 47.37, which suggests subdued movement in the price.

The US Federal Reserve left the key benchmark rate unchanged at 0%-0.25% while stating that the economic recovery remains on track despite a surge in coronavirus infection which put pressure on the greenback and supported the safe-haven asset.

Silver holdings in iShares ETF were unchanged fell by 98 tonnes to 17,177.76 tonnes. The fund NAV is trading at a premium of 0.79 percent.

The US dollar index inched lower to 92.05, down 0.28 percent against the major cross in the afternoon session.

Sriram Iyer, Senior Research Analyst at Reliance Securities said, “International silver prices are trading higher on Thursday early afternoon trade in Asia, tracking strong gold and a weak dollar. Technically, LBMA Silver could trade within the range of $25.00-$25.50 levels.”

“Technically, MCX Silver September resistances are at Rs 67,600 and Rs 67,800. Supports are at Rs 67,300 and Rs 67,000”, Iyer stated.

The spot gold/silver ratio currently stands at 71.41 to 1 indicating that silver has outperformed gold. The ratio pullback after touching the high of 73.42 on July 27.

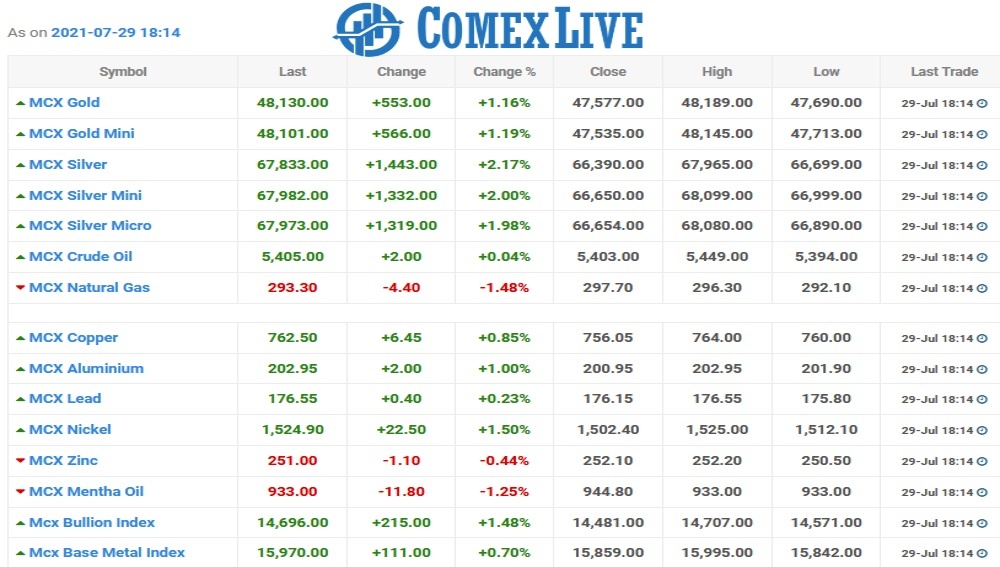

MCX Bulldesk surged 173 points, or 1.19 percent, to 14,654 at 15:22. The index tracks the real-time performance of MCX Gold and MCX Silver futures.

In the futures market, silver for September delivery touched an intraday high of Rs 67,890 and a low of Rs 66,699 per kg on the MCX. So far in the current series, the precious metal has touched a low of Rs 65,656 and a high of Rs 75,215.

Silver delivery for the September contract edged higher Rs 1,408, or 2.12 percent to Rs 67,798 per kg at 15:23 hours with a business turnover of 9,624 lots. The same for the December contract advanced Rs 1,501, or 2.24 percent, to Rs 68,655 per kg with a turnover of 1,308 lots.

The value of September and December’s contracts traded so far is Rs 1,283.60 crore and Rs 117.15 crore, respectively.

Similarly, the Silver Mini contract for August gained Rs 1,260, or 1.89 percent at Rs 67,910 on a business turnover of 18,772 lots.

Kshitij Purohit, Product Manager, Currency & Commodities, CapitalVia Global Research Limited said, “MCX Silver future is trading with strong bullish trend levels of Rs 67,000. LBMA Silver spot has resumed gapped higher and trading towards $25.25. Overall, the trend remains marginally bullish if the price sustains above the support of 15-SMA of intraday chart placed at Rs 66,575.”

At 0958 (GMT), the precious metal rose 2.77 percent and was quoting at $25.56 an ounce in New York.