Gold prices on Friday were set for a second weekly decline as U.S. Treasury yields held near multi-year highs following strong labor market data and hawkish comments from Federal Reserve officials, dampening the appeal for zero-yield bullion.

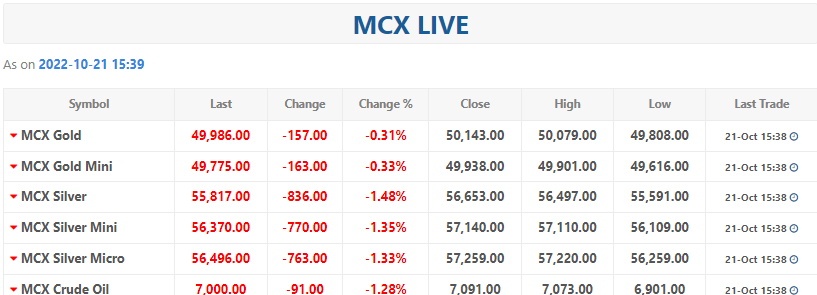

Spot gold was flat at $1,627.20 per ounce, as of 0118 GMT, and lost 0.8% so far for the week.

U.S. gold futures were down 0.4% at $1,630.10.

The benchmark 10-year Treasury yields held near a fresh 14-year peak hit on Thursday while the dollar index

ticked 0.1% higher.

Philadelphia Federal Reserve President Patrick Harker said on Thursday given the current inflation situation, “the Fed is actively trying to slow the economy,” and “we are going to keep raising rates for a while.”

Although gold is considered a hedge against inflation, higher interest rates increase the opportunity cost of holding the bullion, which yields nothing.

The number of Americans filing new claims for unemployment benefits fell unexpectedly last week, indicating the labor market remains tight. A separate data showed U.S. existing home sales dropped for an eighth straight month in September.

Swiss gold exports to top markets China and India increased in September, while shipments to Turkey rose to the highest since April 2013, Swiss customs data showed on Thursday.

Holdings of SPDR Gold Trust , the world’s largest gold-backed exchange-traded fund, fell 0.19% to 930.99 tons on Thursday.

Spot silvereased 0.2% to $18.63 per ounce, platinumfell 0.4% to $910.30 and palladiumdropped 1.4% to $2,028.43.