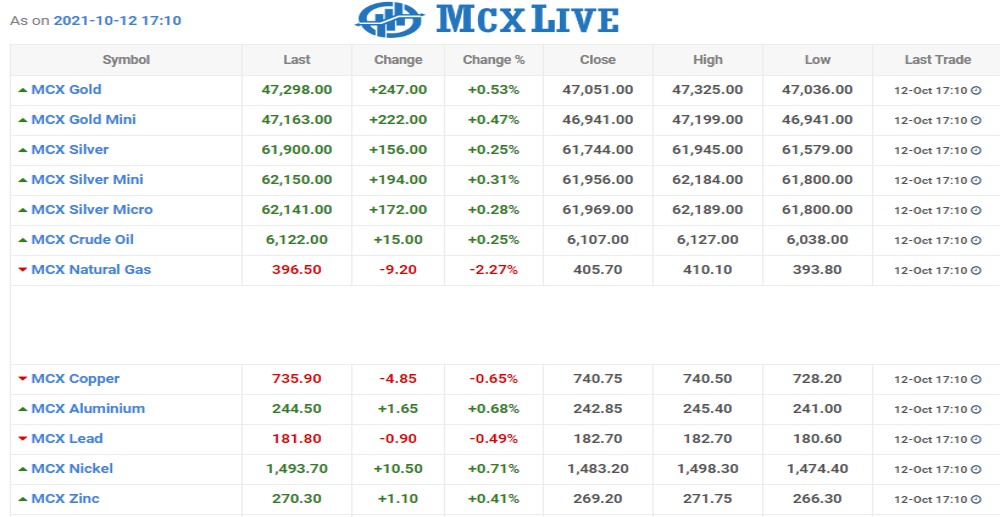

Gold prices edged higher on Tuesday drawing strength from rising inflation fears that has rattled financial markets, although concerns over looming U.S. Federal Reserve tapering limited gains. Spot gold rose 0.2% to $1,757.84 per ounce by 0904 GMT, while U.S. gold futures were up 0.1% at $1,757.70. Risk sentiment in wider financial markets was subdued, as inflation fears Read More

2021

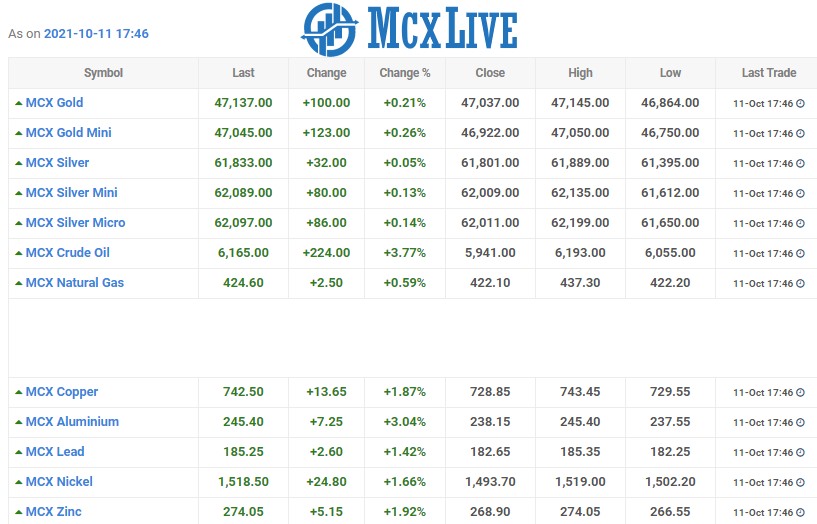

Gold eased slightly on Monday as the dollar firmed on expectations that the Federal Reserve would move forward with its plans to taper economic support despite U.S. September jobs data falling short of forecasts. Spot gold fell 0.2% to $1,752.68 per ounce by 0942 GMT, while U.S. gold futures eased 0.2% to $1,753.20. Spot silver Read More

Gold was little changed on Friday as investors stayed on the sidelines awaiting the confirmation of a strengthening U.S. labour market that could keep the Federal Reserve on track to start unwinding economic stimulus this year. Spot gold rose 0.1% to $1,757.10 per ounce by 0905 GMT, while U.S. gold futures fell 0.2% to $1,756.00. Read More

Gold fell on Wednesday, holding below the key technical $1,750 level, as Treasury yields and the dollar gained in the run-up to Friday’s U.S. labor market report that could influence the Federal Reserve’s tapering schedule. Fundamentals Spot gold fell 0.7% to $1,747.61 per ounce by 0923 GMT, while U.S. gold futures shed 0.8% to $1,747.50. Investors flocked to Read More

Gold prices inched up on Thursday but hovered near a seven-week low, constrained by a strong dollar and expectations of the U.S. Federal Reserve winding down stimulus measures soon. Fundamentals Spot gold was up 0.2% at $1,729.83 per ounce by 0054 GMT. Prices fell to their lowest level since Aug. 9 at $1,720.49 on Wednesday. U.S. gold futures were up 0.4% Read More

Gold prices were flat near a seven-week low on Wednesday, pressured by a rise in the dollar and U.S. Treasury yields on growing expectations of an earlier-than-anticipated interest rate liftoff. Fundamentals Spot gold was flat at $1,735.17 per ounce by 0123 GMT. On Tuesday prices fell to their lowest level since Aug. 11 to $1,726.19. Read More

Oil markets climbed for a sixth day on Tuesday, reversing earlier losses, on fears over tight supply while surging prices of liquefied natural gas (LNG) and coal also lent support. Brent crude futures gained $1.05, or 1.3%, to $80.58 a barrel at 0645 GMT, after reaching its highest since October 2018 at $80.75 earlier in Read More

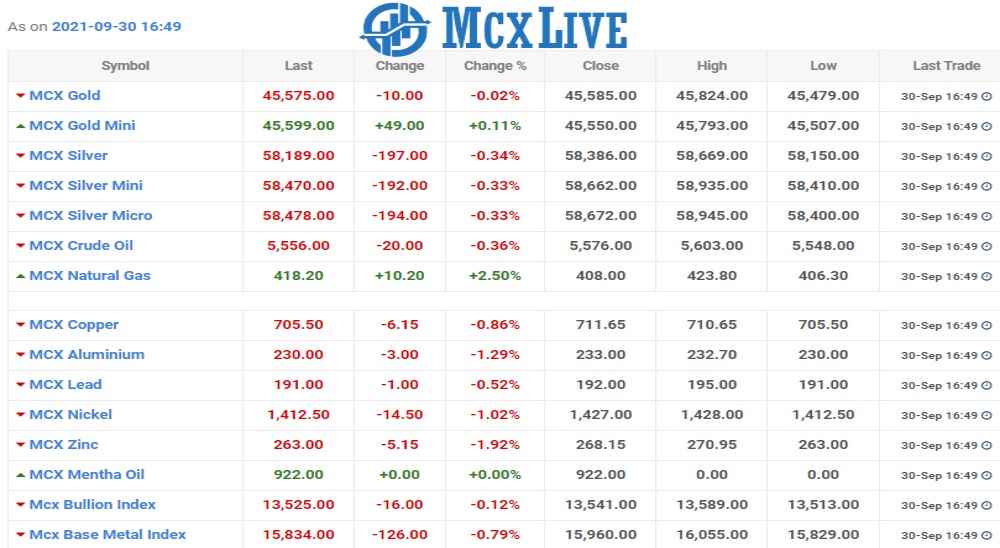

Gold fell 1% on Thursday, pressured by an uptick in treasury yields and an appetite for riskier assets, as investors continued to position themselves for a sooner-than-expected interest rate hike from the U.S. Federal Reserve. Spot gold declined 0.9% to $1,751.56 per ounce by 2:11 a.m. ET and U.S. gold futures settled 1.6% lower at $1,749.80. “We have Read More

Gold prices slipped in volatile trade on Wednesday after the U.S. Federal Reserve signaled a sooner-than-expected interest rate hike and easing of its bond purchases by the middle of next year. Spot gold fell 0.4% to $1,767.38 per ounce by 1943 GMT, while U.S. gold futures settled up 0.03% to $1,778.80. Federal Reserve Chair Jerome Read More

Oil prices climbed more than $1 on Wednesday, extending overnight gains after industry data showed U.S. crude stocks fell more than expected last week in the wake of two hurricanes, highlighting tight supply as demand improves. Prices were also supported as some OPEC members struggle to raise output and by a general sense of energy Read More

Gold prices were flat on Tuesday as investors adopted a risk-averse stance amid caution ahead of U.S. Federal Reserve’s policy meeting where the central bank is expected to provide cues on when it will begin tapering its asset purchases. Bullion is considered as a hedge against inflation and currency debasement likely resulting from the widespread stimulus. Read More

Gold prices were pressured on Monday, hurt by a stronger dollar and concerns the U.S. Federal Reserve might hint at when it intends to begin tapering its asset purchases in its upcoming meeting. Spot gold was little changed at $1,755.84 per ounce, having earlier touched its lowest level since Aug. 12 at $1,741.86. U.S. gold Read More

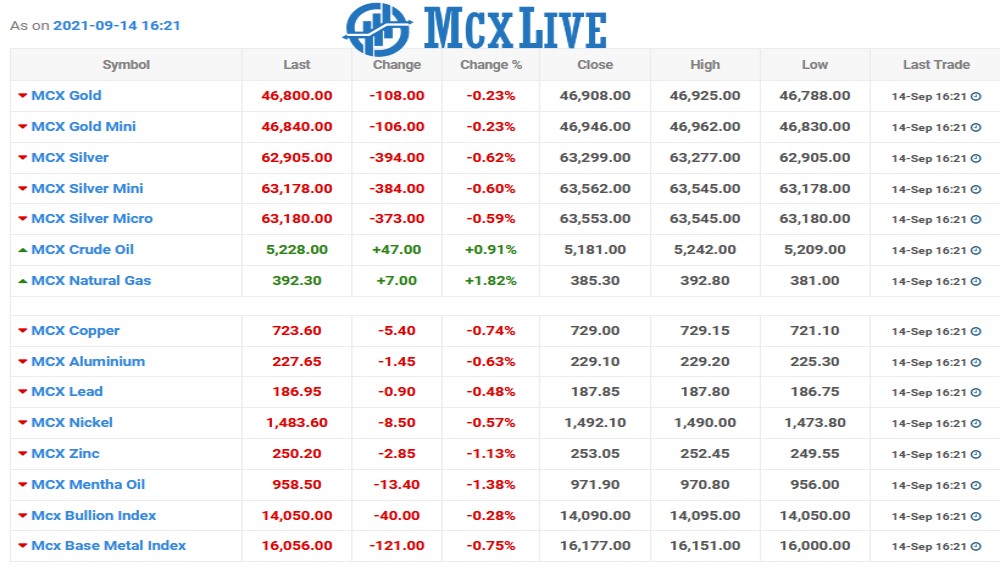

Gold prices drifted lower on Thursday, with a firmer dollar and U.S bond yields diminishing its appeal, as investors turned their attention to next week’s U.S. Federal Reserve meeting for clues on when it would begin tapering its stimulus. Fundamentals Spot gold was 0.5% down at $1,784.35 per ounce by 0859 GMT, while U.S. gold Read More

Gold prices on Wednesday consolidated in a tight range near the key $1,800 level as softer U.S. inflation data fed uncertainty about the Federal Reserve’s tapering timeline. Spot gold was down 0.2% at $1,800.38 per ounce, but slightly off a one-week peak of $1,808.50 hit on Tuesday, in part because the dollar recovered some ground Read More

Gold prices edged lower on Tuesday as a stronger dollar crimped bullion’s appeal ahead of U.S. inflation data that could offer cues on the possible timeline for the Federal Reserve’s tapering. Fundamentals Spot gold fell 0.2% to $1,790.74 per ounce by 0138 GMT. U.S. gold futures eased 0.1% to $1,792.10. The dollar index was steady Read More

Gold bounced above $1,800 on Friday, buoyed by bets that central banks may keep interest rates relatively low to stave off lingering growth risks. But an overall uptick in the dollar, while investors tried to gauge the timing of the U.S. Federal Reserve’s taper timeline, kept bullion on course for a weekly decline. Spot gold Read More

Oil prices ticked lower on Thursday, giving up some of the last session’s gains although a decline in U.S. Gulf of Mexico output following Hurricane Ida provided a floor under the market. Brent was down 18 cents, or 0.25% to $72.42 a barrel at 0107 GMT and West Texas Intermediate (WTI) crude gave up 17 Read More

The market perceived the Fed statement a few weeks ago as dovish, and last Friday’s jobs report, which was disappointing, reinforced that. As a result, the previously oversold precious metals sector is rallying. The charts show there are clear rally targets. Let’s start with GDXJ, the best proxy for most who invest in the sector. Read More

Gold prices firmed on Tuesday, propped up by a softer dollar and prospects of the U.S. Federal Reserve delaying a tapering in its pandemic-era bond purchases. Fundamentals Spot gold rose 0.2% to $1,826.75 per ounce by 0108 GMT. Prices had hit a 2-1/2-month high last week following a disappointing U.S. non-farm payrolls data. A strong Read More

Gold prices hovered on Monday below a 2-1/2-month peak after a disappointing U.S. jobs data signaled that the Federal Reserve could push back the timeline for tapering stimulus measures, bolstering bullion’s appeal as an inflation hedge. Fundamentals Spot gold was steady at $1,826.65 per ounce, as of 0048 GMT. In the previous session, prices hit Read More